Strategies to Avoid Credit Card Debt

Credit can be a helpful tool when a person faces unexpected financial hardship, but it is also a major contributor to many Americans’ debts. The convenience of credit and bonus offers from credit card companies motivates many consumers to spend out of their budget.

Credit can be a helpful tool when a person faces unexpected financial hardship, but it is also a major contributor to many Americans’ debts. The convenience of credit and bonus offers from credit card companies motivates many consumers to spend out of their budget.

Staying out of credit card debt following a bankruptcy is especially important. Most people never want to go through bankruptcy twice, but may accidentally find themselves sliding into old, comfortable habits. Make sure you have a plan after bankruptcy for staying out of debt moving forward.

Credit cards are the easiest, most common source of overwhelming debt that triggers bankruptcy filings. By understanding how to manage credit cards responsibly, it is possible to avoid the stress and uncertainty that come with insurmountable debt. Read on to learn seven strategies to avoid credit card debt. Our New Braunfels, TX bankruptcy attorney is here to help.

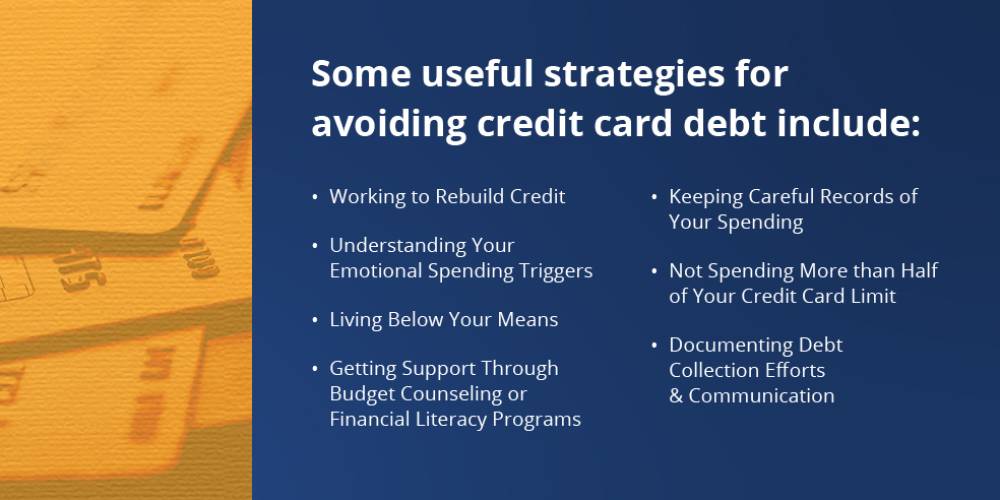

Six Tips for Staying Out of Credit Card Debt

Keep Careful Records of What You Spend

Online shopping has made it particularly easy to overindulge with credit cards. You can spend thousands with the click of a few buttons and it can be very difficult to keep track of your purchases.

According to the Federal Trade Commission, one of the best ways to avoid serious debt from online spending with credit is to keep a record of purchases. This will help you understand how much credit spending is affecting your finances. For some people, they do this with a budget in a spreadsheet. Others do it by writing down every expense on their phone. Whatever you can remember to do consistently is the best strategy for you.

Do Not Spend More than Half of Your Credit Card Limit

As a general rule, you should never spend more than half of your credit limit. This will ensure that you have credit available in a financial emergency. It can also prevent compulsive spending, and it will help your credit score improve. In general, keeping your credit balance below 30 percent of your limit is the best for your credit score.

If You Are Dealing with Debt Collection Efforts, Always Keep a Record

Collection agencies love to harass debtors who have outstanding balances. They often call debtors several times each day to request payments.

Even if you are in collections, it is important to understand that you still have rights. There are laws that limit the strategies collection agencies can use to recover payments. Be sure to keep a record of your communications with debt collectors to protect your rights.

Work to Rebuild Credit Without Falling Back into Debt

Many Texans who file for bankruptcy feel an urgent need to rebuild their credit afterward, and credit card companies know this. It is common to receive pre-approval offers or secured card pitches shortly after discharge. While rebuilding credit is important, falling into the same debt traps can undo the relief that bankruptcy provided.

If you are using a credit card after bankruptcy, stick to a cash-backed secured card with a very low limit and commit to paying the balance off in full each month. Avoid using credit for anything that is not already in your monthly budget.

Understand Emotional Spending Triggers

One of the biggest threats to your financial health after bankruptcy is emotional spending. Stress, grief, loneliness, and even boredom can lead people to overspend, especially online. Keep track of your habits. Do you tend to spend more when you are anxious or when payday arrives? Recognizing these patterns early can help you build healthier financial behaviors and avoid spiraling back into debt.

Live Below Your Means

It can be very easy to look at a little bit of extra money and think, "Great! I have more than I expected and now I can treat myself." Even though this is tempting, and even though you may very well deserve such a treat, getting comfortable with having a little extra is the direction you want to move in to stay out of debt. Even if you do not need the money today, keep in mind that unexpected expenses are part of life and you will definitely find something worthy to spend it on in the future.

Get Support Through Budget Counseling or Financial Literacy Programs

A successful recovery from bankruptcy often depends on education and support. Many cities, including San Antonio and New Braunfels, offer nonprofit financial literacy workshops, budgeting classes, or credit rebuilding clinics. Some bankruptcy lawyers in Texas also partner with credit counselors to help clients stay on track after discharge.

By working with a certified financial educator or using tools like envelope budgeting or zero-based budgeting, people can maintain control over their income and credit use without relying on guesswork.

FAQs About Credit Card Debt After Bankruptcy

Can I get a credit card after bankruptcy?

Yes, but be cautious and start slowly. Most people start with secured credit cards that require a deposit. These are safer options because the risk of overspending is limited by the deposit amount.

Will using credit cards again help rebuild my credit?

If used wisely, yes. Making small purchases and paying them off in full each month can demonstrate responsible credit use, but missing a payment or carrying a balance can quickly hurt your score again.

What if I cannot qualify for a card at all?

You can build credit using other ways, such as being an authorized user on a trusted family member’s card, taking out a credit-builder loan, or using rent-reporting services that show timely payments to credit bureaus. There are many options today for building credit; we can help you identify options that work for you.

Are there any laws that protect me from credit card collectors who are harassing me?

Federal laws such as the Truth in Lending Act and the Fair Credit Billing Act require clear disclosure of interest rates and prohibit unfair billing. Texas state law also prevents some predatory lending behaviors. If you feel you are being targeted unfairly, speak with a consumer protection attorney.

Contact a New Braunfels, TX Bankruptcy Lawyer

If you have recently completed a bankruptcy and are worried about falling back into debt, you are not alone. At the Law Offices of Chance M. McGhee, our San Antonio, TX bankruptcy lawyer helps clients across South Texas manage their bankruptcy, address the reasons they fell into debt, and stay financially stable after discharge. Call 210-342-3400 to schedule a free consultation and learn how to manage your credit with confidence.