Bankruptcy Qualifications: Can You File for Bankruptcy Twice?

For many people, bankruptcy feels like a once-in-a-lifetime decision that offers a way to stop the financial freefall and rebuild stability. But life often throws unexpected challenges your way. A serious medical emergency, job loss, or divorce can leave you in financial distress again, even years after your first bankruptcy. If you are wondering whether you can file for bankruptcy a second time, the answer is yes, but with important restrictions.

For many people, bankruptcy feels like a once-in-a-lifetime decision that offers a way to stop the financial freefall and rebuild stability. But life often throws unexpected challenges your way. A serious medical emergency, job loss, or divorce can leave you in financial distress again, even years after your first bankruptcy. If you are wondering whether you can file for bankruptcy a second time, the answer is yes, but with important restrictions.

In Texas, federal law allows you to file for bankruptcy more than once, but the federal Bankruptcy Code imposes waiting periods between filings. These rules are designed to prevent abuse of the system while still giving honest debtors a chance at a fresh start. Understanding how these waiting periods work is essential if you are considering filing again.

As of July 2025, bankruptcy cases in Boerne, Kerrville, and the surrounding areas are handled through the U.S. Bankruptcy Court for the Western District of Texas. Working with a local Kerrville, TX bankruptcy attorney who understands these rules can make the difference between a successful discharge and a denied case.

How Many Times Can You File for Bankruptcy in Texas?

Legally, there is no limit to the number of times you can file for bankruptcy in Texas or anywhere in the United States. However, filing multiple times is not always practical, and in many cases, it will not result in a discharge of your debts unless specific time requirements are met.

Federal law imposes mandatory waiting periods between bankruptcy filings. These rules vary depending on the type of bankruptcy you filed before and the type you wish to file now. Filing too soon may result in the court denying your discharge, which means you remain responsible for your debts despite the bankruptcy.

What Happens If You File for Bankruptcy Too Soon?

If you file a second bankruptcy before the required waiting period has passed, you can still initiate the case, but you will not receive a discharge of your debts. This means the court could process your filing, but the debts that caused you to file may remain legally enforceable.

Additionally, if you have filed multiple bankruptcies within a short timeframe, you might lose the automatic stay protection. The automatic stay is a critical part of bankruptcy law that immediately stops creditors from foreclosing on your home, garnishing wages, or repossessing property. Without it, filing for bankruptcy may provide little relief.

Before you attempt to file again, it is essential to calculate waiting periods carefully and consider whether other debt relief options might work better.

Can the Court Deny a Second Bankruptcy Filing?

While the Bankruptcy Code allows repeat filings, the court has the authority to deny your case under certain circumstances. If the judge believes you are filing in bad faith (for example, to delay creditors rather than to seek genuine debt relief), your petition may be dismissed.

The court may also deny your filing if you previously failed to comply with bankruptcy requirements, such as attending the mandatory debtor education course or submitting accurate financial disclosures. A pattern of abusive filings can result in stricter penalties, including a bar on filing again for a specified time.

Do Texas Exemptions Apply in a Second Bankruptcy?

Texas has some of the most generous bankruptcy exemptions in the country, allowing debtors to protect substantial assets even in Chapter 7. For example, Texas homestead exemptions under Texas Property Code § 41 allow you to protect unlimited equity in your primary residence, provided it sits on 10 acres or less in a city or 100 acres in the country.

These exemptions apply in both first and second bankruptcy filings. However, repeat filers must take extra care to ensure that all exemptions are claimed correctly. Mistakes in exemption planning can lead to losing property you thought was protected. A knowledgeable local attorney will know how to use Texas’s exemption laws to your advantage, even if you have filed bankruptcy before.

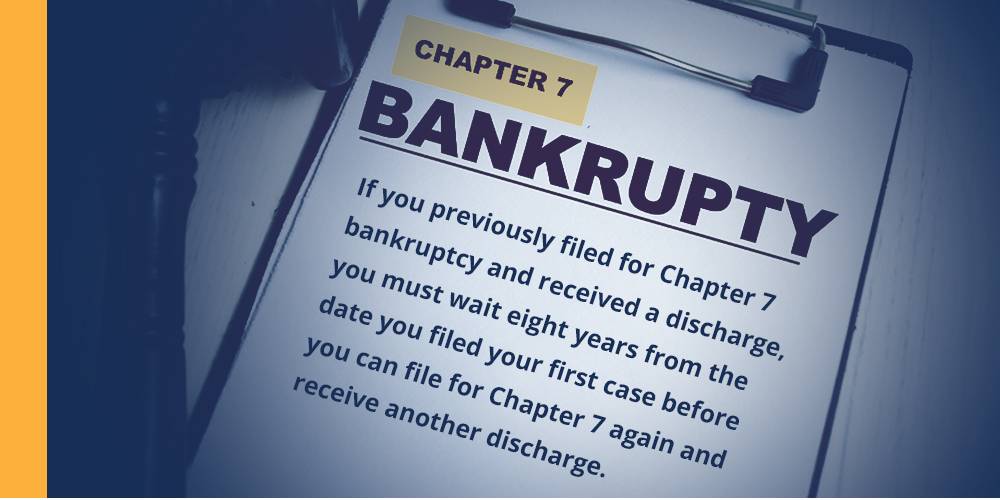

Filing Chapter 7 Bankruptcy a Second Time

If you previously filed for Chapter 7 bankruptcy and received a discharge, you must wait eight years from the date you filed your first case before you can file for Chapter 7 again and receive another discharge.

This rule, outlined in 11 U.S.C. § 727(a)(8), ensures that Chapter 7 — which wipes out most unsecured debts — is reserved for debtors who truly need it. If you file earlier, the court may allow the case to proceed, but will not discharge your debts, leaving you responsible for repayment.

Filing Chapter 13 Bankruptcy a Second Time

If your first bankruptcy was under Chapter 13, which involves a three- to five-year repayment plan, the waiting period before filing another Chapter 13 is much shorter. You can file again after two years from the date you filed the first case. This allows individuals who encounter new hardships to adjust their repayment plans as needed.

Filing for Bankruptcy Under a Different Chapter the Second Time

Switching bankruptcy chapters also affects the waiting period. If you filed Chapter 7 first and now wish to file Chapter 13, you must wait four years from the date of the original Chapter 7 filing to receive a discharge. If you filed Chapter 13 first and now want to file Chapter 7, the general waiting period is six years, unless you already paid at least 70 percent of your unsecured debts in your Chapter 13 plan and the plan was proposed in good faith. These timelines ensure that bankruptcy remains a tool for true financial recovery, not repeated cycles of filing and discharge.

Do Not File for Bankruptcy Without Legal Advice

Before filing for bankruptcy a second time, consult with a qualified attorney. Signing bankruptcy paperwork without understanding your rights and obligations could result in permanent financial consequences. Your lawyer can review your prior filings, calculate the relevant waiting periods, and determine whether Chapter 7, Chapter 13, or an alternative solution is right for you.

Contact a Boerne, TX Bankruptcy Attorney

If you are considering bankruptcy again, get advice before you take the next step. Call a trusted Kerrville, TX bankruptcy lawyer at Law Offices of Chance M. McGhee today at 210-342-3400 to schedule a free consultation. Our firm can help you understand your options and protect your financial future.